By Kari Alldredge, Jan Henrich, Shruti Lal, and Varsha Verma

These four takeaways on top- and bottom-line implications can help consumer-packaged-goods companies navigate the coming year.

In this article, we discuss four key takeaways from our COVID-19 Impact Survey,1 which can help CPG leaders understand the pandemic’s effect on demand and costs. The four takeaways are these: high variability may remain for some time; company performance remains varied, even within the same category; small companies are gaining market share but large ones had the highest absolute growth; and most costs will likely remain higher in 2021.

High variability may remain for some time. CPG brands experienced intense growth during the pandemic: more absolute growth in 2020 than in the four-year period from 2016 to 2019.2 It is unclear, however, whether that growth trajectory will continue in 2021.

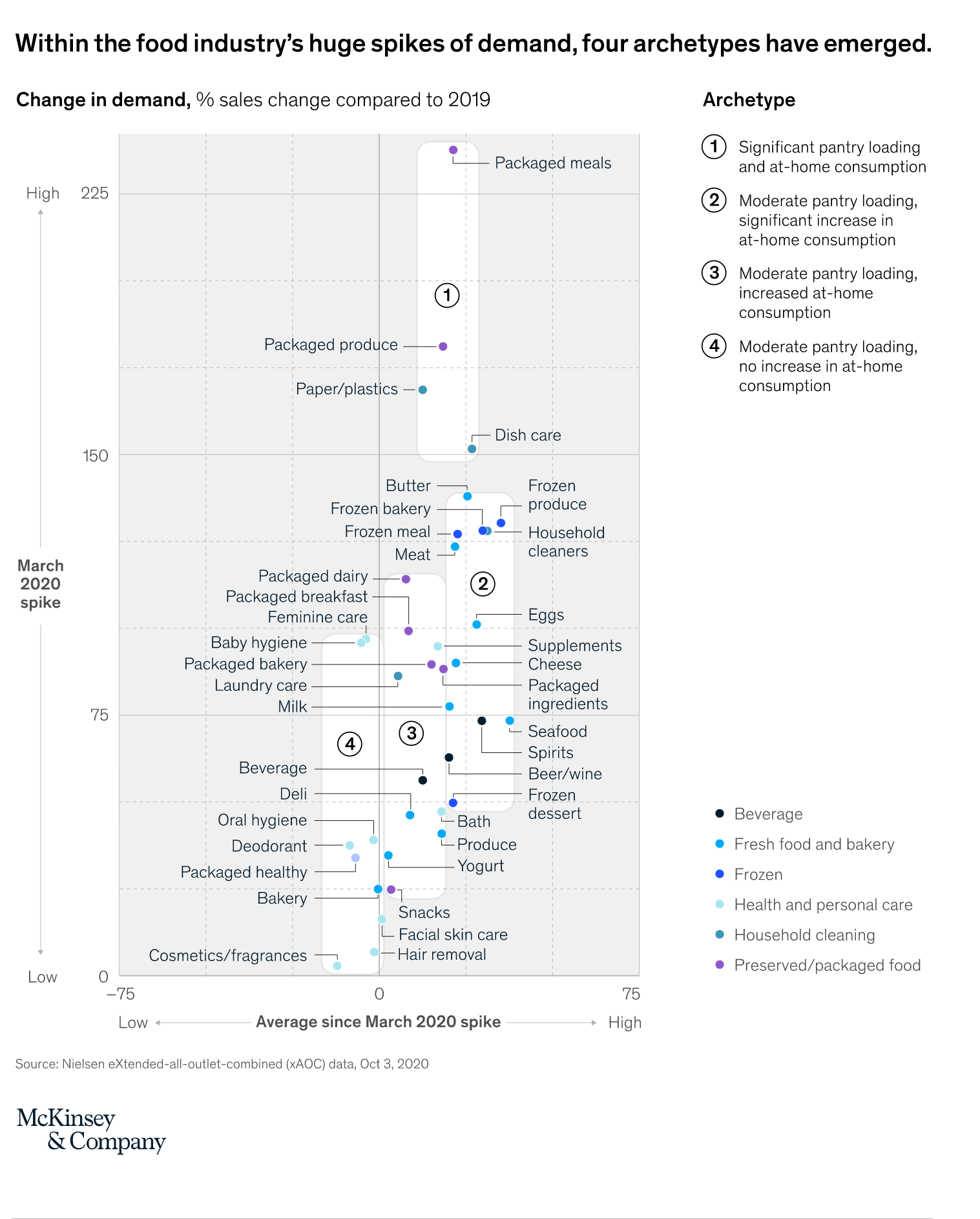

Since the pandemic began, variability has emerged as a strong theme in consumer shopping behavior. Our analysis of US food and pantry shopping activity and at-home consumption from March to October 2020 shows that CPG product categories fall into four archetypes (Exhibit 1). These are based on the level of pantry loading (ranging from “moderate” to “significant”) and on the increase in at-home consumption.

Exhibit 1

As working from home became the norm for many consumers, purchases related to home nesting increased. Thus, we see significant pantry loading and significant at-home consumption of packaged meals, paper and plastics, packaged produce, and dish care. Consumers also bought significantly more fresh food, dairy and bakery products, frozen foods, meats and seafood, and alcoholic beverages for their homes. There was moderate pantry loading of these items.

At-home consumption of snacks, packaged dairy, breakfast and bakery items, and bath supplies increased, with moderate pantry loading. Sales of hygiene products and cosmetics benefitted from moderate pantry loading in March. That was followed by a slight decline in sales, possibly because people used the products less than they had expected to do.

Will these archetypes stick? Our research indicates that 70 percent of Americans believe that their routines will be disrupted in the coming year.3 We expect to see continued higher demand, which has been consistent since March 2020 even as COVID-19 restrictions have ebbed and flowed for categories such as packaged meals, packaged produce, bakery, dairy, dish care, and paper and plastics.

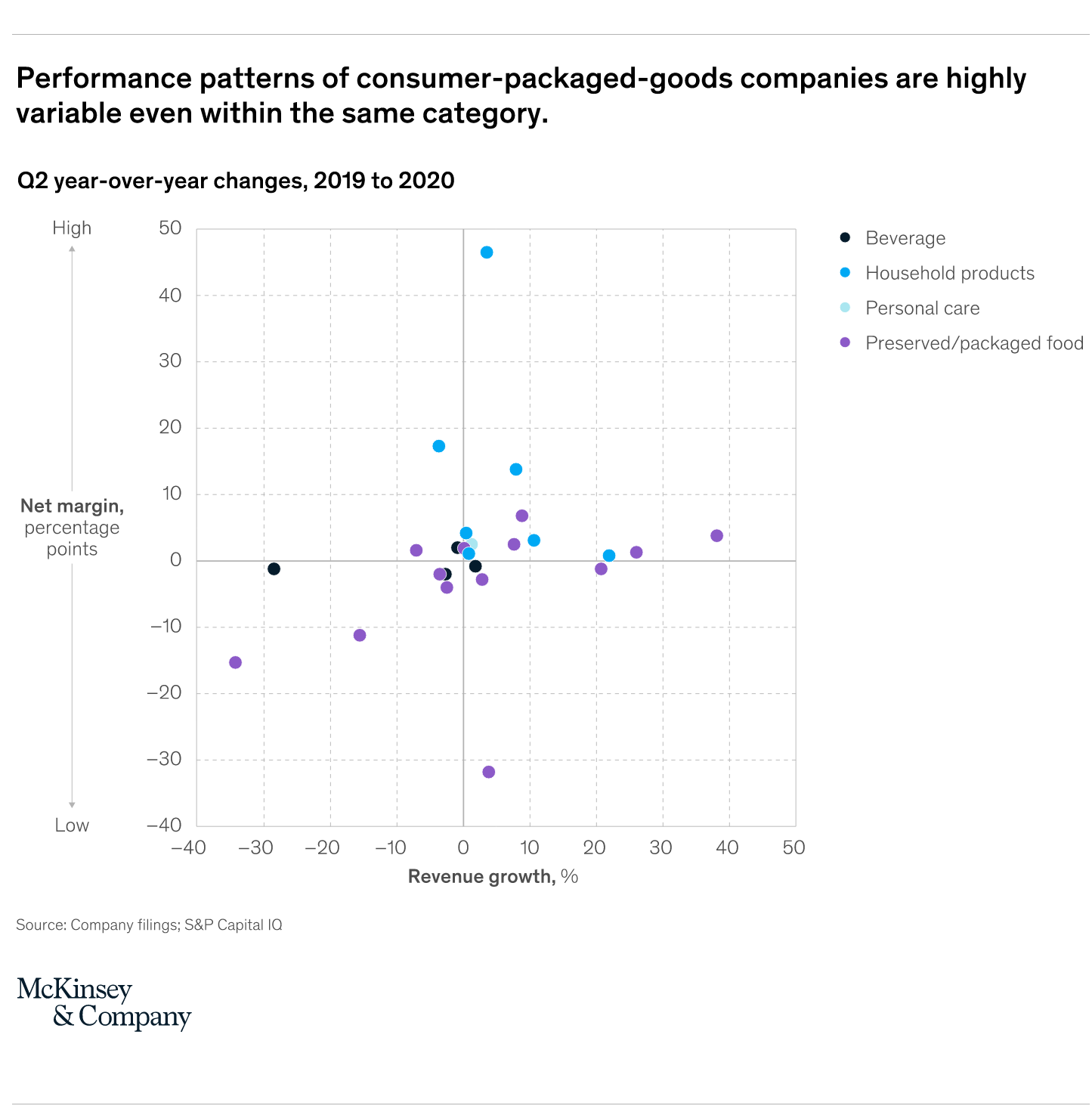

Company performance remains varied, even within the same category. CPG companies—even those competing in the same categories—have performed very differently from one another during the pandemic, in both revenues and margins (Exhibit 2). With consumers spending much more time at home, household products have generally had high sales. Revenues for beverages have declined slightly, probably as a result of the loss of business from restaurants and bars. Preserved and packaged foods have enjoyed revenue growth, although the margin performance of companies has varied.

Exhibit 2

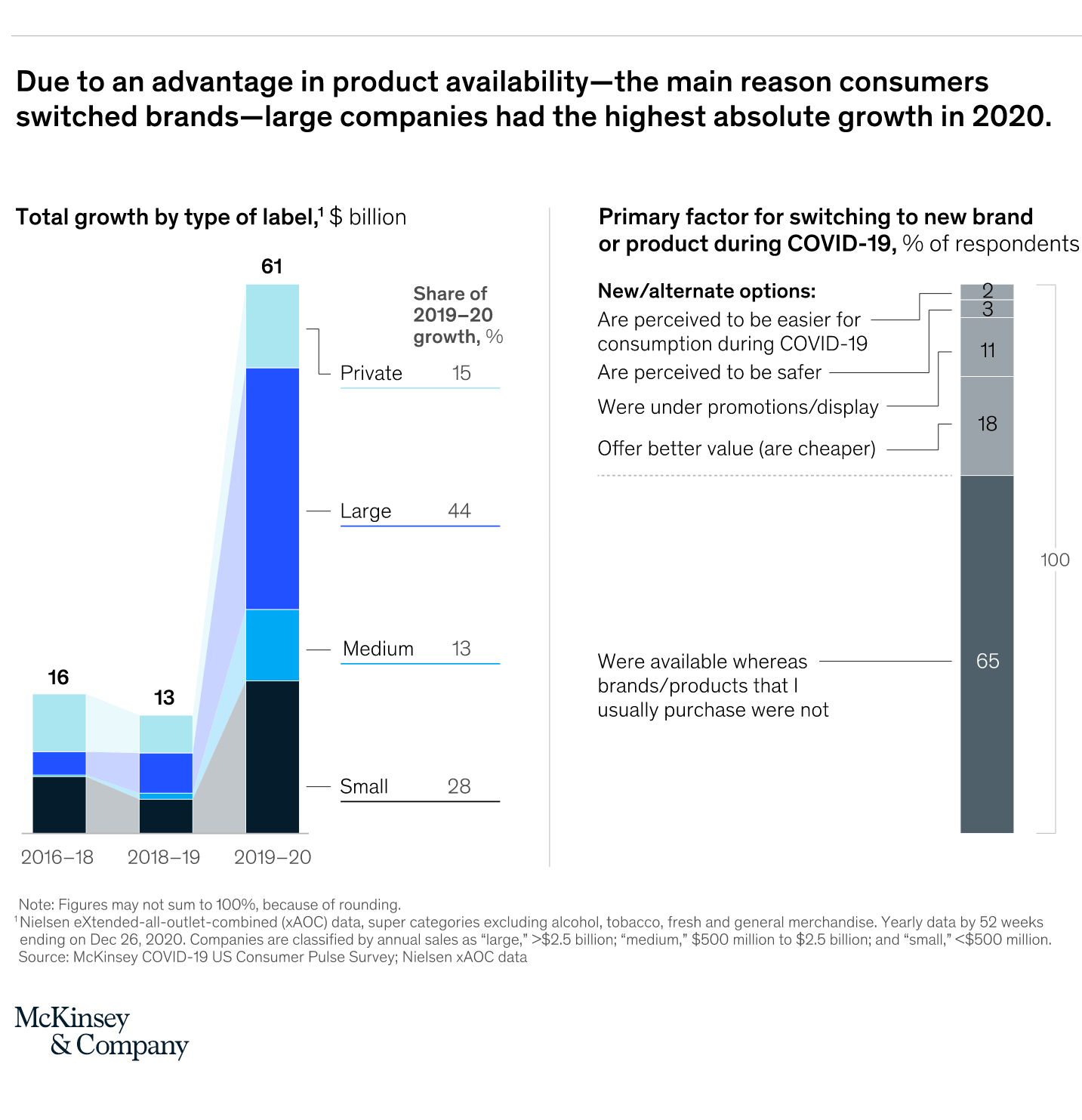

Small companies are gaining market share, but large ones had the highest absolute growth. Large companies had the most dollar growth in revenue last year (Exhibit 3), but only small ones raised their market share—from 18.2 percent in 2019 to 19.2 in 2020. In the same period, the market share of private labels stayed roughly constant (17.5 percent in 2019 and 17.2 in 2020), like that of midsize companies (13.1 percent in both 2019 and 2020). The market share of large companies fell from 51.2 percent in 2019 to 50.5 in 2020.4

Exhibit 3

During the pandemic, 76 percent of the respondents to our COVID-19 US Consumer Pulse Survey experimented with new shopping behavior. Of that 76 percent, 37 percent tried new brands and 26 percent new private-label brands. Consumers switched to new brands during the pandemic primarily because of their availability—an area in which large brands have an advantage (Exhibit 3).

We expect that this kind of behavior will continue well into 2021, which highlights how important it will be for CPG companies to win customer loyalty in the next normal.

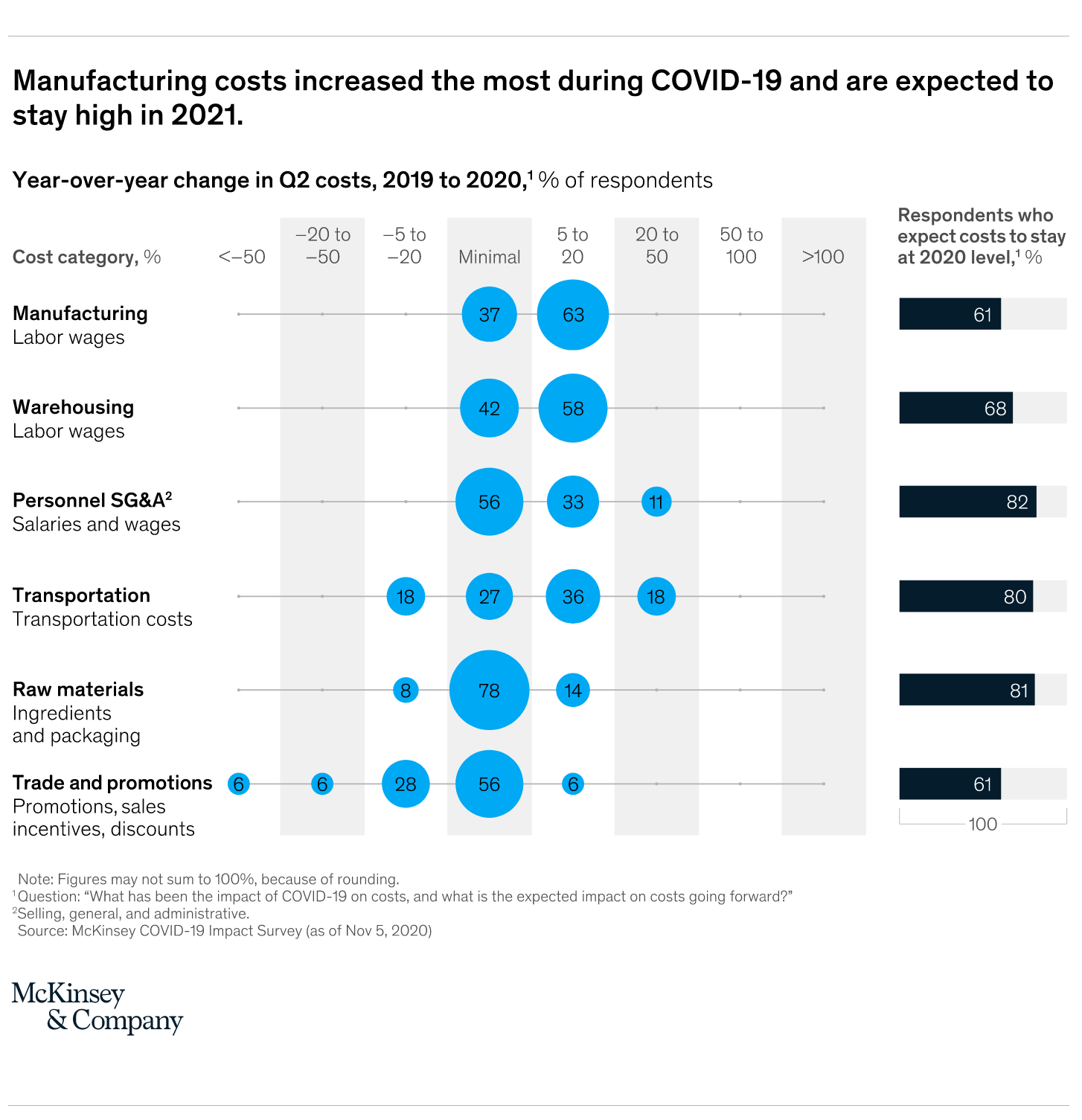

Most costs will likely remain higher in 2021. Since the pandemic began, CPG companies have shouldered increases of up to 50 percent in certain cost categories. Some of these costs could return to prepandemic levels in 2021, but the CPG companies that participated in our COVID-19 Impact Survey expect several of them to remain elevated (Exhibit 4). Survey respondents expect costs to stay at higher levels in 2021, while growth may slow.

Exhibit 4

Despite an approximately 50 percent increase in supply-chain costs for many CPG companies, raw-material costs were stable in 2020 and are expected to remain stable this year. Yet the longer-term implications for lead times and capacity remain uncertain.

In 2020, wages and labor costs in manufacturing increased substantially—from 5 to 20 percent—as a result of COVID-19 pay and overtime. These are expected to stay high in 2021. Warehousing, too, has become more expensive because of higher labor costs and is expected to remain at higher levels in 2021 as well.

Travel and entertainment expenses dropped materially in 2020, not surprisingly, but CPG executives are optimistic that travel restrictions could be lifted in 2021 and that these costs will revert back to 2019 levels.

Looking ahead to the rest of 2021, CPG companies will probably continue to face challenges to both the top and bottom lines. Revenue challenges will include increased brand switching, competition from small and private-label brands, greater price transparency (with the shift to online sales), and pressure from retailers. Both fixed and variable costs will be challenging as volume continues to shift between e-commerce and brick-and-mortar stores and a recession remains a possibility. For leadership teams, the important considerations will include understanding the 2021 cost outlook, making resiliency a C-suite-level conversation, capturing growth while controlling costs, ensuring that upstream and downstream collaboration is part of the 2021 strategy to improve the value chain, and adapting marketing and customer-loyalty programs to a fast-changing environment.